Treasury leak reveals rift between Johnson and Sunak over costs of zero-carbon economy

With weeks to go before the Cop26 climate summit, documents show PM being warned about the risks of damage to the UK from green investment

Last modified on Sat 16 Oct 2021 14.49 EDT

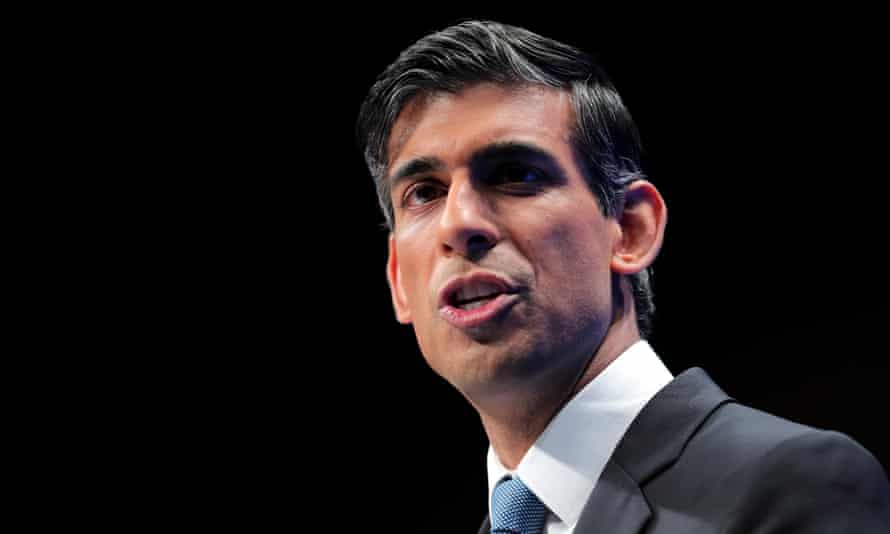

Confidential documents leaked to the Observer reveal an extraordinary rift between Boris Johnson and his chancellor, Rishi Sunak, over the potential economic effects of moving towards a zero-carbon economy, with just weeks to go before the crucial Cop26 climate summit.

As Johnson prepares to position the UK at the head of global efforts to combat climate change and curb greenhouse gas emissions as host of the Glasgow Cop26 meeting, the documents show the Treasury is warning of serious economic damage to the UK economy and future tax rises if the UK overspends on, or misdirects, green investment.

Green experts said the “half-baked” and “one-sided” Treasury net-zero review presented only the costs of action on emissions, rather than the benefits, such as green jobs, lower energy bills and avoiding the disastrous impact of global heating. They said the review could be “weaponised” by climate-change deniers around the world before Cop26, undermining Johnson’s attempts at climate leadership on the global stage.

The internal Treasury documents say that while there may be economic benefits to UK companies from swift and appropriate climate action, there is also a danger that economic activity could move abroad if firms found their costs were increasing by more than those of their overseas competitors.

The leaked papers are understood to have been produced to accompany a slide show given confidentially to key groups outside government in the last month. The documents state: “The investment required to decarbonise the UK economy is uncertain but could help to improve the UK’s relatively low investment levels and increase productivity.

“However, more green investment is likely to attract diminishing returns, reducing the positive impact of ever more investment on GDP. Some green investments could displace other, more productive, investment opportunities. If more productive investments are made earlier in the transition, this risk may be accentuated later in the transition.”

On the risk of additional costs to companies from green initiatives, the documents say: “Climate action in the UK can lead to economic activity moving abroad if it directly leads to costs increasing, and it is more profitable to produce in countries with less stringent climate policies.”

On the fiscal implications, the documents say the cost of moving towards net zero could mean tax rises because of “the erosion of tax revenue from fossil fuel-related activity”. They say: “The government may need to consider changes to existing taxes and new sources of revenue throughout the transition in order to deliver net zero sustainably, and consistently with the government’s fiscal principles.”

Ed Matthew, campaign director at the E3G thinktank, said: “To governments looking to Cop26, this looks unprofessional and embarrassing. The UK is standing in front of the world at Cop26 trying to galvanise ambitious action from every country. If the government has not presented the robust economic case in favour of action, that’s going to significantly undermine those attempts.”

The Treasury’s approach is also starkly at odds with that of business secretary Kwasi Kwarteng and the analysis of the Office for Budget Responsibility (OBR) in a report published in July this year.

On the costs of moving towards net zero, the OBR said in its report: “Between now and 2050 the fiscal costs of getting to net zero in the UK could be significant, but they are not exceptional … While unmitigated climate change would spell disaster, the net fiscal costs of moving to net zero emissions by 2050 could be comparatively modest.”

The Committee on Climate Change, the government’s statutory adviser, has also repeatedly said the costs of action are small and diminishing, at less than 1% of GDP by 2050, while the costs of inaction are large and rising.

While there are concerns over how the costs could fall on poorer households, the CCC chief executive Chris Stark has made clear that ministers can choose to distribute the costs and benefits fairly, through the design of green policies.

Whitehall sources said there was a belief that Sunak was keen to position himself as something of a climate-change sceptic in order to boost his popularity with Tory party members, and draw comparisons with Johnson’s green enthusiasms. “Rishi clearly sees an interest in showing he is not really down with this green stuff. He wants Boris to own the whole agenda.”

A source at the Department for Business, Energy and Industrial Strategy confirmed that the Treasury was “kicking back” against many of the green plans being advanced by No 10 and Kwarteng. “They are not climate change deniers but they are emphasising the short-term risks, rather than long-term needs, which is what we are emphasising.”

In contrast to the Treasury’s caution, Labour committed at its recent party conference to invest GBP28bn extra every year until 2030 to secure a “green transition” creating good jobs with decent wages in the process.

The leak comes as the government prepares to publish its long-awaited net zero strategy, and heat and buildings strategy, which will contain policies on cutting emissions and creating green jobs, including a ban on new gas boilers from 2035 and grants for householders to move to green heating.

The government’s Cop26 president, former business secretary Alok Sharma, is embarking on a frantic last-ditch round of diplomacy, including with Chinese representatives, amid speculation that President Xi Jinping will not attend the talks. The US and the EU are also talking to key high-emitting countries in the final weeks before Cop26, which opens on 31 October.

The Treasury said: “The government is committed to tackling climate change and the prime minister has set out an ambitious 10-point plan to help us achieve that. The Treasury is playing a crucial role in this effort, by allocating GBP12bn to fund the plan, setting up the UK infrastructure bank to invest in net zero, and committing to raise GBP15bn for projects like zero-emissions buses, offshore wind and schemes to decarbonise homes.”