Mark Carney is no ordinary banker. He is the banker’s banker, the superstar banker, the George Clooney of banking, possibly even the James Bond of banking. The accolades bestowed on him are many: he was named one of the 100 most influential people in the world by Time magazine in 2010, the world’s most trusted Canadian in 2011, and hailed as Britain’s most influential Catholic (by The Tablet) in 2015.

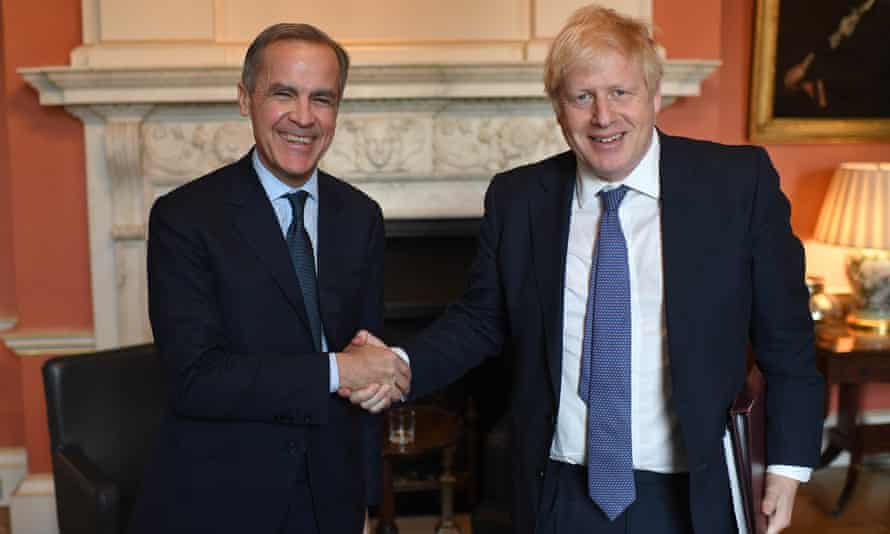

Since leaving his post as governor of the Bank of England in March last year, Carney has turned his attention to saving the planet. He is now the United Nations’ special envoy for climate action and finance, and has been appointed by Boris Johnson as finance adviser for the UK presidency of the Cop26 climate change conference in Glasgow in November. Then there is his new job at Brookfield Asset Management, the world’s second-largest investor in climate-friendly businesses, where he is in charge of the impact fund. (In February, Carney was accused by climate experts of greenwashing after he claimed Brookfield was a “net zero” company. A few days later, he tweeted an acknowledgment that Brookfield’s investments in renewable energy are not the same as having net-zero emissions.) Last month it was announced he had joined the board of US digital payments giant Stripe, tasked with helping businesses fund emerging carbon-removal technologies. And he’s also managed to squeeze in a 600-page book, Value(s): Building A Better World For All. In it, Carney analyses the three global 21st-century crises: the financial crash, Covid, the climate crisis. He concludes that our values have been sacrificed at the altar of what is simply valuable; if we are to have any hope of avoiding an environmental Armageddon we must recover them.

Carney has just joined Twitter. He had no need for social media when he was at Threadneedle Street: pretty much anything he had to say was covered by the press. But fake Twitter accounts moved into the vacuum: Mark Dreamy Carney, for example, carries the biog “intercontinental banking superstar, financial market heart-throb, one of Canada’s greatest exports”.

His first real tweet on 15 February was accompanied by a short film in which a freezing, red-nosed Carney said: “Hi, I’m Mark Carney. No, I’m really Mark Carney. This is part of the Twitter verification process and I’m here standing in a snowbank in Ottawa and I’m joining social media because I’ve been isolating like everybody else for the last several months and I want to reach out. And also because, during that isolation, I’ve written a book called Value(s)… And yes, it’s really me.” Carney’s astonishment at finding himself on Twitter is in itself rather astonishing; at times like these, even he appears to believe the hype.

When we speak on Zoom late last month, he’s back in the warmth of his Ottawa home. “Hiya, Simon, good to see you. Where do I find you?” Carney is the epitome of urbane, open-necked-shirt charm. “I know it’s been cold in the UK, and it’s been snowing, but we’ve got you beat. It’s minus 19 this morning.” I’ve always wondered whether -19C feels that much colder than, say, -2C in Britain. “It’s a good question. Some of the coldest I’ve felt has been in the UK, because the humidity goes right through you. But at -20C you really feel it.” Carney is a natural schmoozer, praising your questions, stressing his candour.

So before getting to the book, we segue to music, football (he’s a huge Everton fan) and his exercise regime – he’s still running marathons in his mid-50s, but only 7km a day in the extreme cold. Carney, who holds Canadian, Irish and UK passports, waxes nostalgic about the great gigs he saw in Canada as a teenager: the Clash, Bowie, the Police. He smiles. “It wasn’t quite so embarrassing at the time to say, ‘I went to see the Police.'” Why is it embarrassing now? “Well, between you and me, they went through a weird phase, right? Sting got a bit…” And he comes to a cautious stop. In his seven years at the Bank of England, Carney had to be very careful – one misplaced word could cause a run on the pound. He has not quite exorcised his instinct to self-censor; rather than answer a question fully, he will raise an ironic eyebrow or offer a knowing smile.

He moves on to house prices. For all his focus on non-monetary values, Carney is still plenty interested in market value. He tells me about the house he rented in London. “The people who owned it sold it when we left. I think they marketed it as my house, because I noticed in many newspapers that my house was being sold! Then it was claimed that I had made great money, which I hadn’t, because I didn’t own it. We were in West Hampstead, basically Swiss Cottage. I like it. Fun. Great there. Not too many bankers!” The way he tells it, you could be forgiven for thinking that the Carneys were slumming it. But the house, with eight bedrooms and five bathrooms, was on sale at GBP5.5m.

Does he prefer to live in an area with few bankers? “Yeah! Do you want to be surrounded by people in finance?” He arches his left eyebrow. “If part of your job is to oversee it, then when you’re home it’s all around you – that’s less attractive. A little diversity in life is not a bad thing.”

Carney’s life story is often told as a fairytale – the kid from the western wilderness who struggled to make ends meet and went on to become a master of the universe. There is some truth in that, but he is the first to admit it’s a gross simplification. He spent the first years of his life in Fort Smith, a tiny town by the Slave River on the edge of Wood Buffalo national park in Canada’s Northwest Territories. He grew up with two brothers and a sister. His father, Bob, was the principal of the local high school, and his mother, Verlie, stayed at home to bring up the children before returning to teaching. When Carney was six, the family moved to Edmonton, and Bob worked in the civil service on Native American and northern affairs, before becoming a professor of education at the University of Alberta.

“I certainly grew up in an academic household. There were lots of books around. He was always going off to social justice workshops.” Carney knows his audience. He pauses when I don’t react. “Doesn’t that sound good, Simon, social justice workshops?” Did his father inculcate him with those values? “Yes, I think so. In terms of the value of knowledge, the sense of community responsibility, which I think is where the public service bent came from.”

Did he always want to be a banker? “It’s a good question. Candidly, I’d gone from Canada to Harvard, had a lot of student loans, and the most effective way to pay that off was to become a banker.” Actually, he says, he fancied being a marine biologist. Was he good at science? “Yes.” Was he very academic? “Yep. Yep. Yep.”

He was a talented hockey player and dreamed of playing in North America’s National Hockey League. “I played at a pretty high level in the end – US college Division I. I was the backup keeper. I was good enough to get to that level, but I knew I wasn’t good enough to get to the top level. A number of my teammates ended up playing in the NHL.”

After completing a PhD at Oxford, where he met his wife, the British economist Diana Fox Carney, he worked for 13 years at Goldman Sachs and earned a fortune. As soon as I mention it, he talks about working on the ANC contract when they came to power in post-apartheid South Africa. Even at Goldman Sachs, he seems to be saying, he was on the right side of history.

He returned to Canada, became deputy governor and then governor of the Bank of Canada, before being headhunted by then chancellor George Osborne to head up the Bank of England. He famously played hard to get, rejecting Osborne’s advances time and again, refusing to do the conventional eight-year term, and forcing the chancellor to improve his offer. Carney’s stint is regarded as successful. Sure, the odd government minister said he was too outspoken, notably on Brexit and the climate crisis. Jacob Rees-Mogg called for Carney’s resignation after he suggested that leaving the EU might trigger a recession, while former chancellor Lord Lamont and former Tory party leader Iain Duncan Smith warned Carney to be “careful” that his own words did not plunge the country into crisis. But under Carney’s tenure, Britain’s banks continued to recover their reputation after they were hammered for their reckless greed following the global financial crisis of 2007-2008.

The financial journalists I speak to tell me how clever Carney is. They also say he knows it and likes to show that he is the smartest person in the room. For all his charm, Carney is known for being thin-skinned when criticised. And for all the ways in which he appears to be a thoroughly modern banker (turning up at festivals, in shorts), he is wholly traditional in others: his press conferences were famously turgid and unquotable. He may well argue that this is how it should have been: part of the job was not to attract headlines.

What does he think was his greatest achievement at the Bank? “Probably the bit that is least visible – changing the way we made decisions. Who’s around the table? The author is always in the room when a decision is made, so the more junior person who has really done the work is there. A more inclusive decision-making process with a more diverse staff. It’s got a long way to go to properly reflect society, but it was an organisation that reflected being more than three centuries old in a world that’s very hierarchical naturally. And it’s much less so now.”

Why did he write the book? “Part of it is selfish, to be candid. I wanted to get my thinking straight. I felt the relationship between value and values was important, but that in the process of writing the book I would come to a more settled and considered view. And the second thing is, I had this one window where I could do it. I got six months’ gardening leave after leaving, and then I found myself locked down. And thirdly, I did feel I should record some aspect of what I’d seen.”

So how did his thinking change? “It became much sharper. I’d underappreciated the commodification factor of putting a price on certain activities.” The book charts the way society evolved until everything had a market value, and how that market value distorts real values. So, for example, an experiment was conducted in which some people were paid to raise money for charity and others did it for nothing; those who did it for nothing raised more. “Paying for blood donation or fundraising actually corrodes the value of the activity and it’s less successful. The related point is that civic and social virtue is like a muscle: it grows with regular exercise. Literally, from a contagion perspective, it becomes what one does as a member of society. So the fact that a million people are volunteering for the NHS now promotes other voluntary activity.”

I wonder how personal the book is. In 2013, columnist Alex Brummer memorably described Goldman Sachs as “the shrewdest but most toxic brand in global finance”. Does Carney look back at his time there and think he prioritised value over values? “It’s an interesting question. When I worked for Goldman Sachs it wasn’t the most toxic brand in global finance, it was the best brand in world finance.” Maybe, but as Brummer points out, the two are not mutually exclusive. “I don’t shy away from the fact I worked there. I learned a lot; I have no regrets. Look, it clarifies some things for me, but I did leave a fairly successful career with prospects in the private sector to work in the public sector on these issues for the greater good. And I spend half my time now working on the issues of climate health and corporate governance.”

Carney is by no means the first Goldman Sachs alumnus to have forged a career in public service (they include Italian prime minister and former president of the European Central Bank Mario Draghi, and former US treasury secretary Steve Mnuchin). Does earning vast sums liberate people to pursue more meaningful careers? “Erm, yeah, it certainly helps.”

Value(s) is an unusual hybrid; at times it reads like an A-level economics textbook, taking us from the history of barter to gold and then paper money; from Adam Smith to Karl Marx and Milton Friedman. At others, it reads like a smart contemporary analysis of the limits of the markets when it comes to the economic crash, Covid and the climate crisis. Sometimes it feels like a wink and a nod to old friends in the City to get in quick on the green gig because this is where the big bucks are. So you’re telling business people you can do good and make a profit? “Yes, exactly. What’s changed in the UK and Europe is that clearly people are saying, ‘Let’s get to net zero, sort it out, put climate above economy.’ And guess what? It flips it around, because if I’m doing something that makes it more likely we’re going to get to net zero: that is valuable in society by definition. If I’m Elon Musk and I’m creating good electric vehicles, then I’ve created something valuable. The most valuable energy company in the US is a renewable energy company. If I can solve the hydrogen equation…”

He stops, worried that he may be misunderstood. “But I’m obviously not a market fundamentalist, right? I believe there are many things we shouldn’t put in the market. I think Milton Friedman was fundamentally wrong. Look, Friedman was a brilliant man, but I fundamentally disagree with him that the only purpose of business is to profit, providing you follow the basic social norms or standards.”

Does he regard his book as optimistic? “It turned out to be more optimistic than I thought it would be. Partly because of the momentum that’s there on climate, and secondly because of what was revealed about people’s values in terms of Covid, which was heartening.” By and large, he believes people have shown solidarity and a degree of selflessness during the pandemic. “In the arc of history over our lifetime, we had this swing to quite an extreme with Thatcher and Reagan, that the answer to everything is to create a market, to put a price on things whether it’s health provision or finance. And the limits and consequences of that approach are increasingly clear.”

Last year, Carney delivered the BBC’s Reith Lectures in front of virtual audiences composed largely of the great and the good, each of them concluding with a Q&A session. Few shared Carney’s optimism that the climate crisis can be tackled largely through the market. Paul Krugman, professor of economics at the City University of New York, asked Carney to “argue me out of the pessimism that I’m feeling right now”. The banker failed. Sir David King, former government chief scientific adviser and climate negotiator, was asked if he shared Carney’s optimism. He replied: “I am extremely worried, and the optimism I have is now rapidly melting away as the ice begins to melt from the two polar regions.”

Is Carney’s book too rose-tinted? No, he says, and he talks about how much Greta Thunberg has done to move the conversation on. When he used to bang on about a net zero carbon economy or “stranded assets” (fossil fuels rendered worthless because they cannot be burned), few people knew what he was on about. Now, he says, both terms are common parlance in business. “I raised it years ago and took a reasonable amount of abuse for exceeding my remit. And here we are today and it’s, ‘How big are the stranded assets? How do I get out? Here’s my net zero plan.’ The whole momentum has shifted. Again I’m not taking credit for it, but that shows you things can move.” The suggestion that the book is overly optimistic touches a nerve. “I’m not Pollyanna-ish about it. I have been around. I’m not just some guy coming up with an abstract theory.”

Carney’s wife Diana, a development economist born to a wealthy pig farming family, has been described in newspapers as a “strident environmental activist”. In 2012 she wrote that Occupy, the protest movement that pitched tents outside the Bank of England a few months before Carney took over, “has provided a voice to many unhappy people”. I ask Carney if his wife thinks he is a woolly liberal and that it’s impossible to save the planet by appealing to self-interest? “Well, I think two things. I think she is very capable of speaking for herself, so I won’t speak for her. Secondly, I don’t think it’s right to say that what I’m saying is, ‘Make some tweaks here and the market will take care of everything.’ But given the time frame, given the scale of the technological challenges, we need all hands on deck. We need the core of the market focused on this issue as the issue.”

Can I ask Diana what she thinks? “Erm, I doubt she would, but, erm, let her decide that. I will ask. I will ask.” (He never gets back to me with her response.) Has she influenced him politically? He laughs, but sounds affronted. “I’m the one who grew up with the father with the social justice workshop. So I know where my values come from.”

Carney and Diana have four daughters, in their teens and 20s. I ask if they have changed him. He nods. How? “It’s not great to admit, but you’re instantly attuned to the still structural embedded barriers that exist around gender, and how you actively have to work to break those down. And the values of my children on issues such as sustainability, broader issues of equality, are strongly held, so all of that feeds back.”

The day before we talked, I listened to his Reith Lectures, and one moment shocked me. It was nothing to do with economics or the climate. It was when he said: “You don’t get rich in public service.” But Mark, I say, you were earning GBP879,000 a year at the Bank of England. “I get it,” he says. “But let’s be clear: I was asked to come and fix something. I didn’t seek it out. I basically had the same job in Canada. I know the UK is the centre of the universe and everything, but I was a G7 governor, I was in charge of all the global financial reforms in my country, and I was asked to come and sort this out.”

Did part of him not want the job? “I didn’t want to do it.” So why did he? “Because it was a challenge. The financial system had basically failed. The new Bank of England had been put together and I had a chance to make that work. Look, I’m grateful and I don’t want to come across as… ” His sentence collapses in on itself. “It was an important experience, but it was not something I wanted to do.”

Is he glad he did? The seconds pass. One, two, three, four. “I did it.” He chuckles. “It helped me write the book.” Another pause. “Yeah, I’m glad I did it,” he concedes eventually. “I have a pride in what was accomplished, yeah.”

But he didn’t regard GBP879,000 a year as good money? He looks embarrassed. “Yes, absolutely. Two things. First, the actual salary was what the salary of the governor was previously and they converted the pension into part of the salary. And, as I pointed out at the time, I rented out this house in Ottawa and the rent was 9% of the cost of the rent in the UK.” He received a GBP250,000-a-year housing allowance with the job. “And second, if I had stayed in private finance, the opportunity cost of me being in public service for 20 years is enormous. Do I care about money? Obviously, I have a family to provide for and stuff, but I am in bloody Ottawa. I am back in Ottawa. If I wanted to maximise my net present value, I’d be sitting on top of some pile of capital.” You can take the man out of the City, but you can’t take the City out of the man.

Most people who know him will tell you that Mark Carney is a good thing; that if anybody can change the practices of entrepreneurs and investors it is him. He is effective not because he threatens their world, but because he is part of it. Or, as he might say, he understands their values.

At the Bank of England and now as finance adviser for Cop26, he has been in constant touch with British politicians. Who is the most impressive? “Gordon Brown,” he answers instantly. Why? “He’s got a comprehensive view of the world that goes from a fair version of an open globalisation and drops down to what’s needed to support individuals. And he has a mind like a hyperlink. I’m not damning the others, but I’ve always felt, if you’re going to have a meeting, what are you trying to accomplish and how can you move the issue forward? Brown is a person of action.”

At 55, Carney is still a relatively young man. His current roles, paid-for and voluntary, seem more an interregnum than a new start. It has often been suggested that his ultimate ambition is to become Canada’s prime minister. There was talk that he initially agreed to only five years at the Bank of England because it would give him time to challenge for the leadership of the Liberal party and stand for election in 2019. Ultimately, he stayed on at the bank, and in October 2019 Justin Trudeau won a second term for the Liberals. The first two people Carney followed on Twitter were Trudeau and former Liberal party leader Michael Ignatieff.

Is he going to be prime minister of Canada one day? “Er, look at the time!” Carney laughs, raises an eyebrow, and is gone.

Value(s): Building A Better World For All, by Mark Carney, is published by HarperCollins, priced at GBP30. To order a copy for GBP26.10, visit guardianbookshop.com.

Mark Carney will be in conversation with Guardian political editor Heather Stewart at a Guardian Live online event on Wednesday 17 March at 7.30pm. Book tickets here